Within minutes of my introduction to the world of short selling hedge funds, I encountered the analogy that remains the best suited to describe the truth to which they subscribe: Bizarro World.

A planet that appears from time to time in the DC Comics universe, Bizarro World is noteworthy for its utter opposition to everything associated with reality on Earth (in fact, another name for Bizarro World is Htrae – “Earth” spelled backwards).

Bizarro World made very infrequent appearances in the DC Comics universe; however what few insights we’ve been able to gain have been telling.

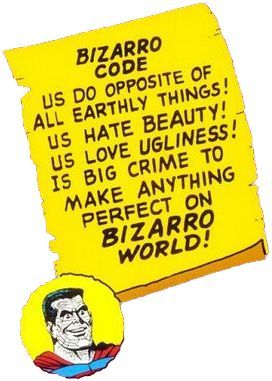

For one, we know that the residents of Bizarro World adhere to a simple moral code: “Us do opposite of all Earthly things! Us hate beauty! Us love ugliness! Is big crime to make anything perfect on Bizarro World!”

Bizarro Superman

For another, consistent with its black-is-white nature, the alpha-superhero of Bizarro World – a Superman-like figure appropriately named ‘Bizarro’ – is in fact a super villain, and one of many.

Fortunately, or possibly unfortunately, the Bizarro World of short selling hedge funds sits side-by-side with our own. Yet, true insights into how it actually operates have been startlingly rare.

Possibly the best behind-the-curtains view came in December of 2006, with Jim Cramer’s infamous admission as to how short selling hedge funds do (and indeed, according to Cramer, “must”) operate, moving the Bizarro World citizenship of that group from theory to undeniable fact.

See for yourself:

Cramer: “You can’t foment. You can’t create yourself an impression that a stock’s down. But you do it anyway because the SEC doesn’t understand it. So that’s the only sense that I would say that it’s illegal.”

Bizarro translation: “Us do opposite of all Earthly things! Us can break law to make money because regulator not understand regulations!”

Cramer: “Look what people can do. I mean that’s a fabulous thing! The great thing about the [stock] market is that is has nothing to do with the actual stocks. Look, over maybe two weeks from now the buyers will come to their senses and realize everything they heard was a lie…”

Bizarro translation: “Us hate beauty! Us pervert capital markets to make them hostile to small, promising businesses and technologies! Us stock market has nothing to do with actual stocks!”

Cramer: “These are all what’s really going on under the market that you don’t see. What’s important when you’re in that hedge fund mode is to not do anything remotely truthful – because the truth is so against your view, that it’s important to create a new truth to develop a fiction.”

Bizarro translation: “Us love ugliness! Us hate truth! Us prefer fiction!”

Cramer: “I think that it’s important for people to recognize the way that the market really works is to have that nexus of ‘hit the brokerage houses with a series of orders that can push it down’, then leak it to the press, and then get it on CNBC (that’s also very important), and then you have kind of a vicious cycle down. It’s a pretty good game.”

Bizarro translation: “Is big crime to make anything perfect on Bizarro World! Us make money by wrecking public companies! And here on Bizarro World, Jim Cramer not even pretend to be friend of small investor! Oh yeah…CNBC official network of Bizarro World!”

(Lest any suppose these clips have been taken out of context, I strongly encourage everybody to download and view the 10 minute conversation in its entirety.)

On Bizarro World, villains are treated like celebrities while the law-abiding are scorned and ostracized. So it should come as no surprise that on CNBC (the official network of Bizarro World), short selling hedge fund managers are called “titans” while those who question them are dismissed with a wink and a smirk.

Of course, this would seem consistent with the seemingly inverted reality that is short selling, where – as opposed to traditional investors who earn profits when they buy low and later sell high – shorts aspire to do the same by first selling high and then buying low.

While on the surface short selling might appear to have been invented on Bizarro World, that’s not true. Shorting is (as has been stated time and again on this blog) a healthy part of a normal market.

What was invented on Bizarro World, however, is shorting’s insidious doppelganger: naked short selling, which is a practice ripped straight from the Bizarro World welcome guide. Unlike legitimate short selling, which requires first borrowing the shares one sells short, naked shorting skips that step, allowing criminals to sell not only something they do not own, but something that does not even exist, except as a tradable electronic ledger entry which they themselves conspire with corrupt brokerages to create.

This, in turn has the effect of artificially increasing the supply of a company’s shares. In other words, on Earth, only companies get to issue stock, whereas on Bizarro World, it’s the naked short sellers that issue shares of a company’s stock, with impunity, sometimes in quantities rivaling the number of legitimate, company-issued shares in circulation (with the expected impact on share price).

Or, should I say, naked short sellers used to be able to do this.

The truth is, since shortly after the onset of the economic crisis naked short sellers themselves helped to spark, naked shorting has become an increasingly difficult crime to commit.

The result?

Despite the fact that we’re in the midst of an epic bear market – when one would normally expect short sellers to thrive – the biggest short selling hedge funds are getting hammered.

Today, Reuters business writer Svea Herbst-Bayliss has a shocking overview of the breadth of the situation, which she begins by comparing to Waterloo – the battle which forever put an end to Napoleon’s aspirations of world domination.

Based on insiders’ insights into forthcoming letters to investors explaining their performance over the first and second quarters of 2009, Herbst-Bayliss predicts that “To anyone considering hedge fund investments in the coming months, the data will illustrate that these managers who cashed in on last year’s financial markets crash now rank as the $1.4 trillion hedge fund industry’s worst performers.”

Specifically, Herbst-Bayliss notes, “In the first six months of 2009 [short selling hedge funds] lost 9.38 percent, compared with the 9.55 percent that other hedge funds gained.”

Most notably, the story quotes Brad Alford, a professional hedge fund advisor and investor, who says, “Every few years short-sellers have their day in the sun. Then things revert to normal where the markets rise and life becomes so difficult for them that many just go out of business,” he added.

In case you missed it, you might want to re-read Alford’s quote to make sure you catch what makes it so telling: that a rising market can be bad for short sellers.

But how can that be, given the recently-ended bull market – possibly the greatest in economic history – saw short selling hedge funds such as SAC Capital, Kynikos Associates and Third Point Capital experience mind-boggling growth, while a month-long rise in what is otherwise shaping up to be one of the greatest bear markets in economic history (when the shorts should be thriving) may prove to be their ultimate doom?

Talk about Bizarro World investing!

The difference, I suspect, is naked short selling: a crutch-like tool that allowed the shorts to defy gravity while the market soared, the effective removal of which has left them atrophied and uncoordinated when forced to fend for themselves in a market where capable, legitimate short sellers should thrive.

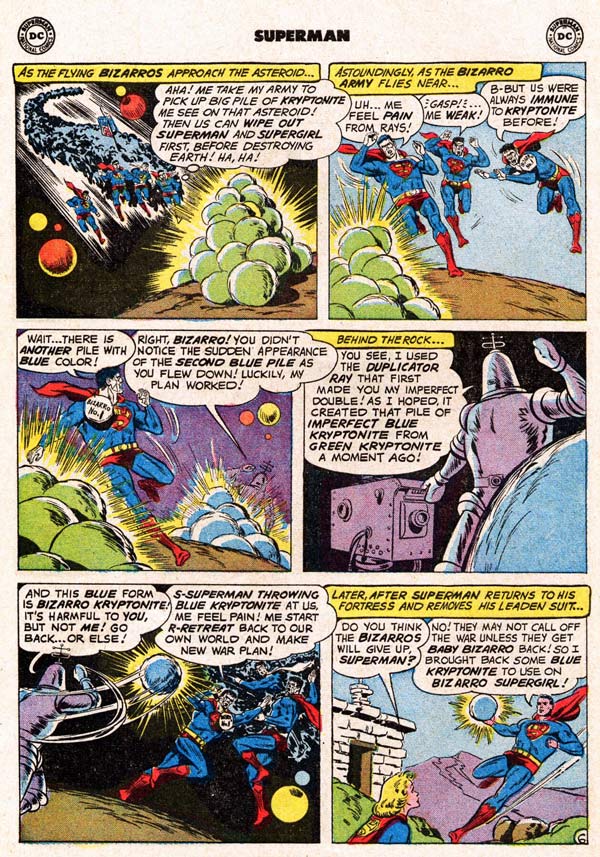

Or maybe a more apt metaphor is that of Kryptonite, the green version of which makes Superman weak and Bizarro strong, while the blue version has the opposite effect. For a long time, a captured media and SEC equipped short selling hedge funds with a big, fat slab of green Kryptonite, which their own hubris has caused to be replaced by a bit of the Bizarro-toxic blue stuff.

Will July of 2009 be the short sellers’ Waterloo?

Will short selling hedge funds’ greed simply assume another form?

Will the economy recover before it’s too late to matter?

Find out what happens in the next episode of Deep Capture!